HOW TO CHOOSE THE RIGHT STOCK BROKER IN KENYA (Without Getting Played)

By Set Free Capital CBO - your partners in financial wisdom and real-life freedom

But before you dive in, there’s one thing you absolutely need: a stock broker.

When most Kenyans hear the words “stock market” , the first thought is: “Hii kitu ni ya watu wa MBA, ties kubwa, na calculators.” But here’s the truth - investing in shares is not rocket science. In fact, if you’ve ever sent money via M-Pesa, compared prices in Gikomba, or argued with a conductor over 20 bob, you already have the instincts you need to survive the Nairobi Securities Exchange (NSE).

Think of your broker as the matatu you’re boarding for your financial journey. The destination? Financial freedom. The question is—are you hopping into a sleek, well-maintained shuttle with Wi-Fi, or a rickety mathree that breaks down every two kilometers? That decision can make or break your investing journey.

Let’s break it down step by step.

Why You Can’t Skip a Broker

In Kenya, you can’t just stroll into the NSE and start buying Safaricom or Equity shares like you’re grabbing tomatoes at the market. The law requires you to go through a licensed broker. Your broker opens and manages your CDS account (basically your stock “bank account” ), executes your trades, and makes sure your shares are safe.

No broker = no access to the market.

So choosing one is like choosing your boda guy in Nairobi traffic: pick the wrong one and you’ll either lose time, money, or even peace of mind.

What Makes a Good Stock Broker?

Here’s where most Kenyans go wrong. We just pick the first name we hear or the one a friend suggested. Then three months later we’re complaining, “Aii, hawa watu wananiwekea stress.”

To avoid that, here are the three golden rules for choosing wisely:

-

Regulation is King 👑

Always check if the broker is licensed by the Capital Markets Authority (CMA) and listed as a member of the Nairobi Securities Exchange (NSE) . This is your safety net. If things go wrong, you at least have somewhere to report—not just a ghost office on Koinange Street. -

Reputation & Stability Matter

How long have they been in business? Do they look like a “one-man show” running from a backroom, or a serious institution with history, systems, and clients? Longevity and transparency mean they’re less likely to disappear with your hard-earned pesa. -

Technology & Accessibility

In 2025, if your broker doesn’t have a proper website, a working app, or an easy way to track your trades, that’s a red flag. You don’t want to call ten times just to check if your shares were bought. Look for platforms that are modern, user-friendly, and don’t give you headaches.

Where to Actually Find Brokers

So, where do you go shopping for your broker? Don’t worry, you don’t have to walk around town asking random strangers. Kenya has three main places to find legit, listed brokers:

1. Central Bank of Kenya (CBK)

Yes, CBK isn’t just about currency rates and Governor speeches. They actually publish a list of all licensed investment firms and brokers. You’ll find them under “publications → licenses → member firms of the Nairobi Securities Exchange.”

It’s not the most interactive list—more like a dry Excel sheet—but it’s official. Think of it as the “yellow pages” of stock brokers. From there, you can Google individual firms and check out their websites.

2. Nairobi Securities Exchange (NSE) Website

This is the real action center. Under the “Trade” section, you’ll find a list of about 15 registered brokers with links to their online platforms. Here, you can actually click through to their websites, see if you can open an account, and even test their systems.

Names you’ll bump into include: Faida Investment Bank, Kestrel, Old Mutual, Standard Investment Bank, NCBA, KCB Capital, Suntra, and AIB-AXYS . These are the big boys and girls of the Kenyan stock market.

Some of them will wow you with sleek platforms, while others might look like they were last updated during the Kibaki era. Either way—this is where you start.

3. Central Depository and Settlement Corporation (CDSC)

This is like the equity bank for your shares—the place where all stocks are safely stored electronically. They also keep a list of brokers and their contact details. Plus, their FAQs are pure gold:

- Can you have multiple brokers? (Yes, but each account is tied to one broker at a time.)

- Can you use your shares as collateral? (Yes, you can actually take loans against them.)

- How do you switch brokers? (Simple forms, nothing complicated.)

Basically, the CDSC ensures your stocks don’t vanish into thin air.

🔍 Red Flags to Watch Out For

Let’s be real. Not every broker in Kenya deserves your trust. Here are quick “danger signs” that should make you run:

- Dead Websites: If their official site can’t even load, imagine what their trading system looks like.

- Poor Customer Service: If you have to beg to get a response, leave them. Remember, your money deserves respect.

- Shady Histories: If you Google them and all you see are scandals, negative reviews, or “account suspended” notices, that’s your cue.

Trust your instincts. If it feels wrong, it probably is.

💸 So, Which Broker Should You Choose?

Here’s the truth - there’s no single “best” broker for everyone. The right one depends on what you value most:

- Low fees? Look for brokers with minimal commissions.

- Good Tech? Go for those with apps and smooth online platforms.

- Customer Support? Pick the ones with responsive teams and branch networks.

- Big Name Trust? Banks like KCB, NCBA, or ABSA have licensed brokerage arms you might feel safer with.

📌 The point is: do your homework. Visit their sites, test their platforms, even call their offices if you must. This isn’t about rushing - it’s about finding the right “vehicle” for your financial journey.

Final Word

Investing in the stock market is one of the smartest ways to grow your money in Kenya. But just like boarding a matatu, the ride is only as smooth as the driver you trust.

So before you jump in, remember:

- Confirm regulation

- Check their reputation

- Test their platform

Once you’ve got the right broker, you’re set to start your wealth-building journey.

And here’s my challenge to you: Don’t just dream about financial freedom. Take the first step. Research a broker today, open a CDS account, and begin.

Because in Kenya, the future belongs to those who prepare - not those who complain on Twitter about “hii system imechoka.”

Now, tafadhali tell me - which broker do you trust, or which one are you eyeing? Drop it in the comments. Let’s learn from each other.

💡 Take the Next Step With Set Free Capital

Ready to get serious about your finances?

Visit our website to grab the tools that will help you track, plan, and grow:

- Excel Money Tools Pack – KES 800 only

- Includes templates for budgeting, tracking expenses, calculating net worth, and more.

- Kingdom Finance – First Edition eBook – KES 300

- A biblical guide to saving, investing, and understanding financial principles with practical insight into available investment opportunities.

- Kingdom Financial Planner – KES 1,500

- A full package with planning pages, money trackers, budgeting tools, goal setting sheets, and biblical finance wisdom. This planner is part education, part action.

You can also:

- 📞 Book a one-on-one session with a certified financial advisor.

- 👩❤️👨 Book as a couple and align your finances as a team.

- 🗣️ Invite us for a speaking engagement for your group, church, or team.

- 🧭 Join Set Free Capital CBO — a purpose-driven financial movement. Membership is only KES 1,500.

For a one-time membership fee of only Ksh 1,500 , you get lifetime access to a treasure chest of resources - some completely FREE - including our powerful Kingdom Finance eBook that breaks down everything you need to know about building wealth God's way.

But that’s not all...

You also become part of our vibrant online community - a safe, encouraging space where we:

- Share real-time investment tips

- Alert you to new and rising opportunities

- Celebrate wins together

- Grow our financial knowledge side-by-side

- And yes... hold each other accountable like a true success squad

This isn’t just a membership it’s about fulfilling the call of God to finance His work.

"Most advisors are far better at generating high fees than they are at generating high returns. Instead of listening to smooth salesmanship, investors should choose brokers and advisors who are transparent, trustworthy, and focused on low-cost, long-term investing."

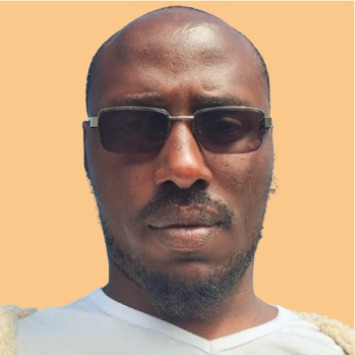

Mophat Mwangi, Financial Analyst

📌 Want more tools?

We’ve got free and premium resources on our website — from planners to retirement guides to calculators. Join our lifetime membership for just Ksh 1,500 , and get access to:

- The Kingdom Finance eBook

- Budgeting templates

- Investment Opportunity Alerts

- And many more ...