Investment: The one investment you MUST have

Read More

Set Free Capital CBO transforms ordinary-income earners into financially stable individuals by helping them understand money, build practical skills, and discover opportunities that can help you earn, save, invest and grow your wealth with confidence.

We help you discover real investment opportunities and provide simple ways to participate through our collective programs.

We believe true wealth begins with wisdom, the kind that flows richly from the Word of God.

We equip people with financial literacy, marketable skills for income generation, and connections to real work opportunities - so they can earn, plan, and invest confidently.

Many people want to grow wealth but don’t always know where to start, who to trust, or how to stay disciplined.

We help you understand how money works, how to plan wisely, and how to participate in opportunities that match your goals and risk tolerance.

Our approach blends:

There are a multitude of reasons you have to join us but you only need one

Unlike generic advice, Our coaching adapts to individual goals, risk tolerance, and financial realities. This ensures every recommendation and strategy is practical and impactful for each client’s journey to financial freedom.

Clients receive ongoing motivation, regular check-ins, and constructive feedback, which keep them committed to their financial plans and help them overcome obstacles. This active support boosts discipline and accelerates results.

Our coaching teaches clients how to confidently manage money and investments on their own, reducing reliance on external opinions and enabling smarter, self-sufficient financial decisions—key skills for lasting financial independence.

We help clients create realistic budgets, manage expenses, eliminate debt, save consistently, and invest wisely—holistic approaches that improve financial well-being, reduce stress, and enhance overall quality of life.

Our coaching provides a safe space where clients can ask questions freely, receive honest advice, and progress at their own pace without sales pressure or stigma—fostering confidence and financial resilience.

Our team’s specialized knowledge saves clients time and frustration by delivering clear, actionable advice focused on what really matters for their success.

Your learning journey with Set Free Capital:

Learn in a simple, practical way. Join our seminars, webinars, or workshops — or invite us to your chama, team, organization, or workplace. We’ll tailor the training to support your goals and employee development.

Attend or Invite Us

Our dashboard offers a quick overview of available investment opportunities and highlights a few CMA-approved providers in each space. It’s designed to help you understand, compare, and make more confident decisions as you explore and compare what the wider market offers.

Visit the Opportunities Dashboard

Join our collective programs whenever you’re ready. Start small, grow steadily, and build good habits that fit your life and goals.

Explore Collective Programs

Learn new skills in a supportive, hands-on environment. Some of our courses are completely free, and others have a small, affordable fee. Every student also receives free financial-literacy training so you can start work life with smart money habits and a strong foundation for building wealth.

Explore Courses We Offer

Be part of our trusted team. We connect you with fair-pay opportunities in your community — whether you’re skilled or simply willing to help and learn. Examples: cleaning, caregiving, errands, plumbing, electrical, laundry, babysitting, office help, and more.

Apply to Join the Team

When something needs to be done, we’ve got someone you can trust. Our team supports homes, offices, and businesses — kindly, professionally, and affordably. Examples: residential & office cleaning, caregiving, laundry, drivers/chauffeurs, riders and deliveries, electrical, plumbing, errands, and general support.

Request Help TodayDiscover our clear, step-by-step work process designed to make your financial journey simple and effective. From your first consultation to personalized coaching sessions and ongoing support, we tailor every phase to fit your unique needs. Explore how our structured approach keeps you motivated, accountable, and steadily progressing toward lasting financial freedom.

We begin with a personalized financial assessment. We review:

No judgment, just clarity. This step helps us identify where you stand today, so we can build from solid ground.

Everyone’s journey is different. We create a tailor-made plan to suit your situation:

You’ll receive a practical, achievable roadmap that reflects your reality and goals.

We help you:

This is where stability begins — when every shilling has a purpose.

It’s not just about managing money — it’s about growing it. We explore ways to:

No income is too small to grow. We help you think and act like a wealth builder.

We work with you to:

This step helps you regain confidence and financial breathing room.

We don’t leave you after the plan. We provide:

We walk the journey with you — because real change needs support, not just advice.

We make wealth-building simple, practical, and exciting. Whether you earn a little or a lot, we’ll help you uncover how your current income—and the resources already around you—can start generating passive income, growing your money, and moving you closer to the life of your dreams.

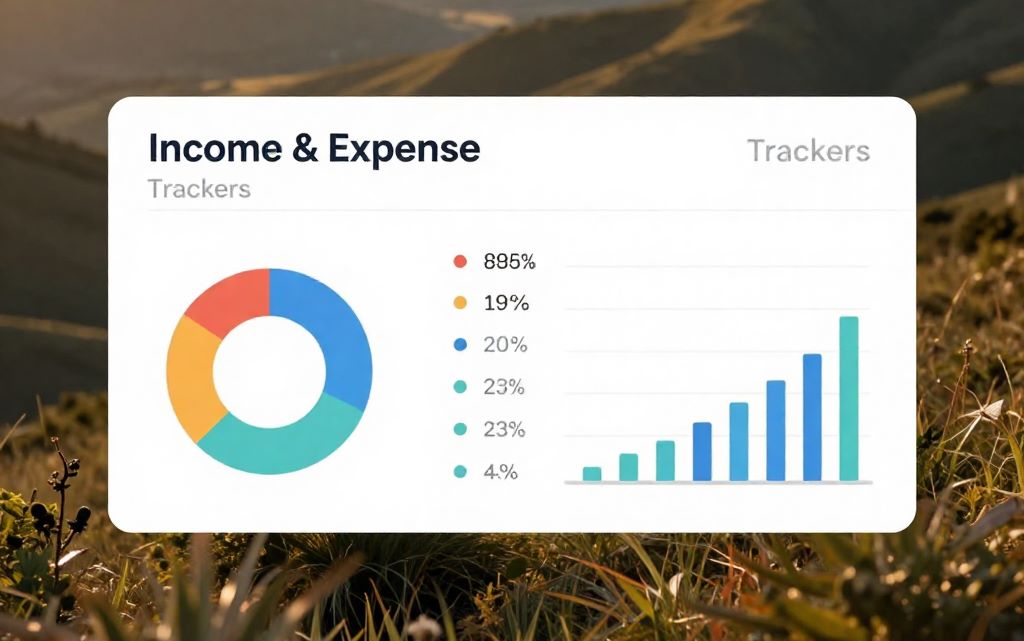

FREE MONEY TRACKERS - built right inside the dashboard.

Keeping track of money shouldn’t feel complicated.

Our simple Income & Expense Trackers help you see where your money goes, stay disciplined, and make better decisions - all for free.

See investment options in one place - built right inside the dashboard.

It is designed for learning first - participation second.

The dashboard helps you:

PARTICIPATE TOGETHER - with structure and accountability.

Our collective programs give participants a guided way to save, invest, and grow with consistency.

They are built to:

INVITE US - or join one of our sessions.

We offer practical financial literacy trainings for groups, organizations, families, and individuals - both online and in‑person.

Our services include:

Meet the passionate experts behind your journey to financial freedom! Our dedicated team combines years of experience, personalized coaching skills, and a genuine commitment to your success. Get to know the people who will support, motivate, and guide you every step of the way toward achieving your financial goals and transforming your life.

I am passionate about guiding people in spiritual growth, cultivating ethical living, and helping others align their daily lives with Kingdom values.

I blend marketing creativity with financial counselling, helping people and organizations grow, manage money wisely, and build confidence for lasting success in both business and personal finance.

I am passionate about helping ordinary income earners become better at managing personal finances and build strong, Kingdom-focused financial stability

I am here dedicated to delivering clear, data-driven insights that help you make informed decisions and unlock your financial potential.

I enjoy walking with young people starting out in life—helping them grow, make smarter money choices, and build a future they’ll be proud of.

I blend creativity and coaching—crafting visuals that leave lasting impressions while helping individuals grow, thrive, and achieve their personal and professional goals.

OUR UNWAVERING COMMITMENT TO INTEGRITY

People choose us repeatedly due to our proven track record, innovative solutions, and dedicated support that ensures every project exceeds expectations.

Our services include:

We believe financial wisdom should relieve pressure - not create confusion.

OUR UNWAVERING COMMITMENT TO INTEGRITY

Let’s keep learning together.

Contact Us

Don’t just take our word for it—see how our coaching has transformed lives! Check out our testimonials to hear real success stories and get inspired to start your own journey to financial freedom.

Have questions about achieving financial freedom or our coaching services? Our FAQ has all the answers you need! Click through to get clear, helpful information that will guide you toward making confident financial decisions and getting the most out of your journey with us.

Start by tracking your income and expenses. Knowing where your money goes is the first step to taking back control.

We encourage aiming for 50% of your income to build financial stability quickly. But start where you are—even 2% or 5%—and grow steadily toward that goal.

Yes! Even small, consistent investments grow over time. The key is to start early, be consistent, and remain disciplined.

Saving keeps your money safe and accessible. Investing helps your money grow, often at higher returns, but involves a bit more risk.

List your income, track your expenses, and set spending limits. Our financial planner includes a ready-to-use budget template, income tracker, and goal-setting pages to make budgeting simple.

List all your debts, prioritize repayments, and cut unnecessary expenses. A plan and small consistent steps make a big difference.

It’s the point where your money works for you—you’re not stuck living paycheck to paycheck, and you can make life choices without financial stress.

Yes. Giving is a biblical principle. Even in tough times, generosity opens the door for breakthrough and shifts your mindset toward abundance.

MMFs typically offer better returns than savings accounts, plus daily interest and easy access to your money—making them ideal for short-term savings and emergency funds.

MMFs are regulated, stable, and don’t rely on member discipline. They provide consistent returns and allow you to build wealth independently and securely.

Start by managing your current income better and exploring simple income streams that fit your schedule. Our planner has investment tracking tools and side hustle guides to help you begin.

Active income is what you earn by working (like a salary or business). Passive income is money you earn without constant effort—like returns from investments or rental income.

Because having a plan—and someone to walk with you—makes all the difference. A coach helps you avoid mistakes, stay focused, and reach your financial goals faster. Reach out to us for personal financial advice and planning—we’re here to help.

Yes, you absolutely can. Rock bottom is a great place to rebuild because the only way from here is up. You don’t have to figure it out alone—reach out to us for free financial advice and a fresh start.

Join our membership and access tools like a money tracker, net worth calculator, and budget planner—plus quarterly Kingdom Finance eBooks with fresh insights. Get regular updates on investment opportunities and benefit from ventures easier to pursue as a group. Enjoy ongoing financial guidance, shared resources, and a supportive community committed to helping you grow, thrive, and steward wealth with purpose.

JOIN NOW

Dive into our blog posts below to unlock expert tips and the insider secrets to your path to financial freedom! Click now and start your journey!

For all enquiries, please email us using the form below.

Cosmas Ndeti Rd, Imaara Daima

Nairobi, KE 00100

+254 790 800 520

info@setfreecapital.com