HABITS THAT ARE KEEPING YOU IN FINANCIAL STRUGGLE - A Brotherly Chat

I want to walk you through 10 habits that might be sabotaging your financial growth. As I go through them, be honest with yourself. If something hits home, no shame. Just take it as a sign that it's time to grow.

Hey fam,

Let’s have a real talk today-just me and you. This isn't one of those complicated money lectures. This is just a big bro looking out for you and saying: “There are some habits we’ve picked up that are keeping us broke - and we need to do better.”

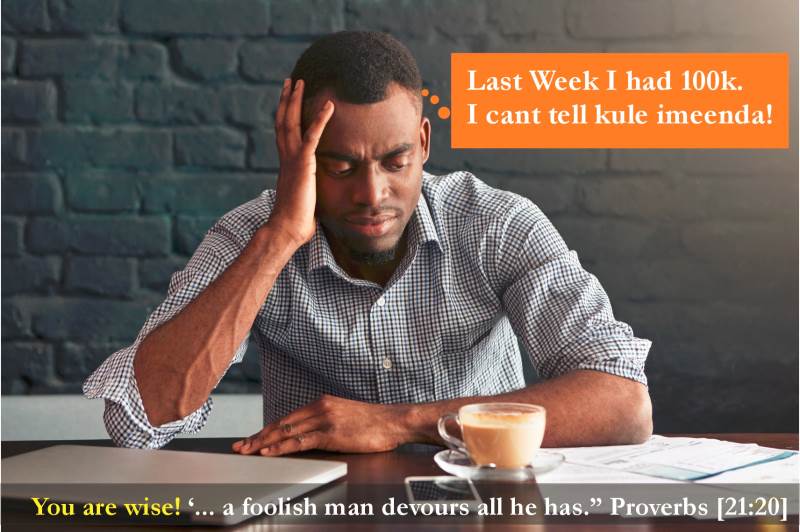

1. Lifestyle Creep – When Money Comes, Don’t Let Pressure Take You!

Let me tell you, this one dealt with me proper. As a businessman, every time I made extra money, I was quick to upgrade – better phone, better house, better means of transport. I thought, “I’ve worked hard, I deserve soft life.” But I was playing myself.

Here’s the truth: when your income increases, don’t rush to increase your lifestyle. That money is not for instant enjoyment – it’s for securing your future. When you get a better job or your hustle starts booming, please resist the urge to move to a bigger house, upgrade your car or start eating lunch at fancy places daily. Instead, take that increase and invest it first. Let that money start working for you.

Only upgrade your lifestyle using profits from your investments, not the income itself. In fact, here's a golden rule I live by now: I use the children or grandchildren of my money – not the parents – to upgrade life.

So if you earn KES 100k more per month now, don’t immediately add KES 80k worth of new expenses. Chill. Give it 6 to 12 months. Put that extra cash into something that will make you more money – land, a side business, stocks, unit trusts, whatever makes sense for you.

Then when your investments start bringing in babies (profits), use those ones to fund that road trip to Diani or that sleek upgrade. That way, you’ll never slide back to square one.

2. Draining Habits – Your Wallet Can’t Survive This Lifestyle Forever

Let’s be real – some habits will chew your money faster than a mjengo fundi at lunchtime . No matter how much you earn, if your lifestyle is leaking cash like a sieve, financial stability will just be a dream.

Take for example, the guy who loves women too much . One here, one there, lunch here, shopping there, trips to Naivasha... my friend, you’ll end up financially finished. Or maybe it’s not women, but alcohol and weekend "form lazima" culture – Friday till Sunday, you’re either buying rounds or recovering from the rounds you bought

Now here’s the math part (and it’s mathing):

Most average social drinkers easily blow KES 5,000 per weekend . Let’s tone it down – say KES 10,000 per month on sherehe. Now imagine instead of spending it on temporary vibes, you put that KES 10,000 every month into an account earning 12% compound interest per year, and you never withdraw it – just leave it to grow. After 30 years ?

You’ll have over KES 35 million

Yes, thirty-five million shillings!

That’s not a typo. That’s real, powerful compounding.

That’s land. That’s apartments. That’s passive income. That’s financial freedom. All from choosing long-term goals over short-term thrills.

So ask yourself:

Is that hangover worth missing out on 35 million?

Are those draining habits really worth your future?

We’re not saying never enjoy life – we’re saying don’t let temporary pleasure steal permanent progress . Replace draining habits with investing habits, and your future self will high-five you all the way to the bank.

3. Not Paying Yourself First

This one? It totally changed the game for me.

I used to spend on my needs first - rent, food, transport, a few “small enjoyments” - then hope to save what was left. Guess what? There was never anything left . Somehow, the needs just kept multiplying.

For the longest time, I couldn’t figure out why saving

felt impossible. Then boom - lightbulb moment:

The trick is simple but powerful - pay yourself first.

The moment your salary hits M-Pesa or your bank account, slice off your savings and investments before touching bills or shopping. Treat it like a bill you must pay. Why? Because if you don’t save first, you’ll spend it all. Every single time

Let’s say you earn Ksh 20,000 and want to save Ksh 10,000. Don’t wait. Immediately stash that Ksh 10K in your savings or investment account. Even better — set up a standing order so the money moves automatically before you even see it. That way, you won’t start negotiating with yourself

Now, live like someone who earns Ksh 10K. You’ll be shocked how creative you can get on a tighter budget—cutting back on impulse spending, choosing cheaper options, and skipping that extra pizza delivery.

It may feel tough for the first month or two, but soon, it becomes your new normal. And trust me, this is how you start walking toward financial freedom —not with huge income, but with discipline.

4. Having a Consumer Mindset

"Wacha tufungue roho, my friend".

Are you spending to look rich... or actually become rich?

That 100K handbag or the latest phone might give you “likes” on Instagram, but after that? It gathers dust or gets replaced. Now imagine taking that same 200K and putting it in a bond, an equity, or even money a market fund. That money starts to work for you - silently, steadily.

You see, real wealth doesn’t shout. It’s not loud. It doesn’t need validation. It’s that quiet guy in a ka-old Probox who owns apartments. The mama mboga with simple stall in Toi market who owns 3 Super Metro buses.

So instead of spending to impress people who won’t help you when things go south, start spending like you’re building a future - not a show

Shift from "How will they see me?" to "What am I

building?"

Because at the end of the day, it’s not the Gucci belt

that pays school fees - it’s the smart investments

behind the scenes.

5. Treating Money Like a Taboo Topic

You know how sometimes we act like talking about money is bad manners? Yeah, that’s holding us back. If you never talk about money - how to make it, grow it, or save it - then how will you ever get better with it?

Start having money conversations with friends, your partner, or even mentors. Join groups where people talk about finances openly. Just like learning any skill - if you're around it, you’ll pick it up. It’s not awkward - it’s wisdom.

6. Spending Without a Plan

If you just spend money as it comes, with no plan, that’s dangerous. It’s like going on a journey with no map. You need a budget - something simple.

-

Ask yourself every month:

- How much did I make?

- What do I want this money to do?

- How will I keep myself on track?

Even just sitting down for 30 minutes every month - what I call a “money date” with yourself - can totally shift how you handle your cash.

7. Playing Victim With Money

“I don’t earn enough.”

“I can’t control what happens.”

“This economy is crazy!”

Listen, I hear you - and I’ve been there too. But here’s

the truth:

you may not control the economy, but you can control

your financial choices.

Take charge. Appoint yourself the CFO (Chief Financial Officer) of your life. Can’t earn enough? Add a side hustle. Can’t save? Start small. You’re not helpless. You’re powerful - when you decide to be.

8. Procrastinating & Avoiding the Real Issues

“I’ll start next month.”

“I’ll fix it when things settle.”

Sound familiar?

If you set a budget and it flops halfway through the month, don’t throw the whole plan away. Adjust! Do a mini budget for what you have left and keep moving. Don’t let one bad week cancel your whole year.

Stop avoiding. Face the mess. That’s where growth begins .

9. Living Above Your Means

I know this one stings - but let’s keep it real.

If you're spending more than you earn, or using debt to impress people, you're digging a hole. Try this rule:

- 50% of your income = needs (rent, food), fun stuff

- 50% = savings, investments, debt repayment

If your needs are taking 50% or more, you might need to

cut back or boost your income. Either way, don’t ignore

it.

Wealth isn’t about what you spend - it’s about what

you keep.

10. Falling for Get-Rich-Quick Schemes

If it promises “easy money” fast - it’s probably not safe.

Real wealth takes time, learning, and consistency. Don’t invest in something just because it’s trending or someone you trust mentioned it. Always do your homework. Ask:

- Where’s the money being invested?

- What’s the risk?

- Who’s running the show?

Smart money grows slowly - but it grows safely.

11. Complaining Instead of Doing

Last but not least: stop complaining and start taking

action.

Yes, the economy is tough.

Yes, taxes are high.

Yes, things are expensive.

But we all have the same 24 hours . Some are using it to build. So can you.

Take a course. Start that side hustle. Learn how to budget or invest better. No more “budgeting doesn’t work for me” talk. It does work - you just haven’t learned how you can make it work yet.

12. Not Knowing Where Your Money Goes – That’s How It Disappears Quietly

Let’s be honest – if I asked you how much you spent on

food last month, would you know?

How about entertainment? Or shopping?

If your answer is somewhere between

“Uuum... not sure” and

“Aki si much” , we have a

small problem.

Because here’s the truth:

You can’t fix what you don’t know.

Money that’s not tracked is money that walks out silently. You’ll be wondering why you’re broke by the 15th and yet “I haven’t even bought anything serious!” 🤦🏾♂️

Start tracking - Use an app, a notebook, or even a good old Excel sheet. I personally use one. A special one we have developed and made available for you on our website.

No more guesswork. When you know where your money is going, you take back control. And once you do that, building wealth becomes a whole lot easier.

Let’s Wrap This Up – No Shame, Just Progress

Bro, sis - this isn’t about making you feel bad. It’s about saying, “You’ve got what it takes to do better.”

We’re here to walk with you - step by step. At Set Free Capital , we’re a team of financial planners, advisors and counselors. We’re here to help you align your money life with purpose, peace, and progress.

So here's your call to action:

- We have free resources for members

- We have budgeting tools , classes, and templates

- We host training sessions and community events.

- Membership is only KES 1,500 and unlocks so much value

Let this year be different. Let it be the year you finally take charge of your finances - not alone, but with a community that cares.

Want to Go Further, Faster? Join the Kingdom Finance Family!

If you’re ready to take your savings and investment journey to the next level, we’ve got something just for you.

For a one-time membership fee of only Ksh 1,500 , you get lifetime access to a treasure chest of resources - some completely FREE - including our powerful Kingdom Finance eBook that breaks down everything you need to know about building wealth God's way.

But that’s not all...

You also become part of our vibrant online community - a safe, encouraging space where we:

- Share real-time investment tips

- Alert you to new and rising opportunities

- Celebrate wins together

- Grow our financial knowledge side-by-side

- And yes... hold each other accountable like a true success squad

This isn’t just a membership it’s about fulfilling the call of God to finance His work.

"Less talk. More action. More growth. Am cheering you on - let’s build wealth, together. "

John Kangu, Team Leader, Financial Coach

📌 Want more tools?

We’ve got free and premium resources on our website — from planners to retirement guides to calculators. Join our lifetime membership for just Ksh 1,500 , and get access to:

- The Kingdom Finance eBook

- Budgeting templates

- Investment Opportunity Alerts

- And many more ...