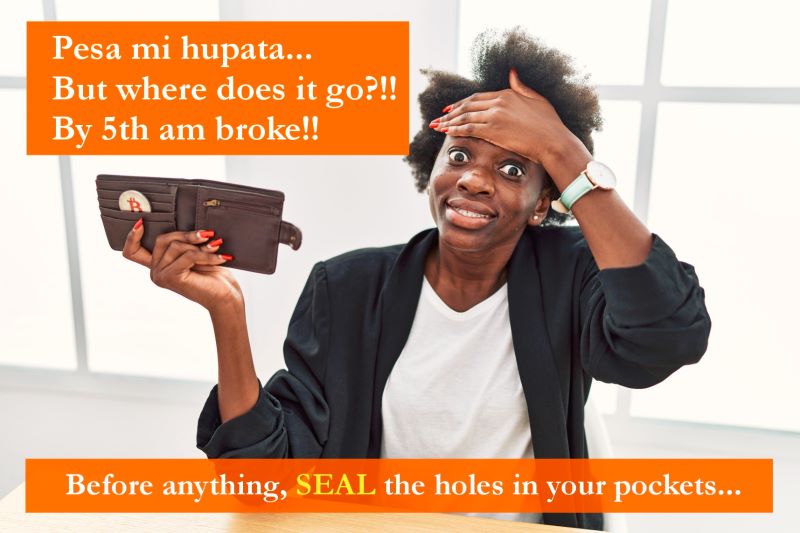

3 COSTLY MONEY LEAKS DRAINING MANY POCKETS DRY – And How to Seal Them

Money. That thing we chase daily, hustle for, sacrifice weekends for, and sometimes even lose sleep over. We chase it like a shadow, yet for many, it keeps slipping away.

Why? Because unless you master the basics - saving, budgeting, and living within your means - wealth creation will always remain just a dream.

Too many of us want to jump straight into the “big leagues.” We want stocks, real estate, crypto, side hustles that sound glamorous on Twitter Spaces. But let me be honest with you: no one becomes a great investor before becoming a disciplined saver.

It’s like farming. You cannot talk about harvesting maize before buying the seeds. Savings are the seeds of every financial journey. Without them, there is no harvest.

But saving is exactly where most Kenyans stumble. And not because we don’t earn enough, but because of sneaky financial leaks - habits, mindsets, and pressures that quietly bleed us dry. Today, I want us to confront the three biggest leaks keeping Kenyans broke, and more importantly, how to seal them for good.

1. “I’ll Save When I Earn More” - The Lie That Never Ends

How many times have you said, “This salary is too small. When I earn more, that’s when I’ll start saving properly.”

The truth? That day rarely comes.

SI know this from experience. At one point, I was doing well in business and told myself that once I got bigger contracts, I’d finally start saving. Then I landed a U.S. project that doubled my income. I felt on top of the world. But instead of saving, I upgraded my lifestyle. Bigger house, fancier meals, better phone. When the contract ended, I had nothing to fall back on. No cushion, no savings. The pain was humbling.

Here’s the reality: if you cannot save from 10,000 shillings, you won’t save from 100,000. The more you earn, the more “needs” you suddenly create. Lifestyle inflation is a silent thief.

That’s why you must learn the Principle of pay yourself first. The moment money hits your account, put a portion aside before bills, before shopping, before nyama choma with the boys. And here’s our philosophy: aim to live on only 50% of your income and save or invest the rest. That 50% rule is the golden guarantee of financial independence and early retirement.

Don’t panic if you can’t start at 50% immediately. Begin with 5%, 10%, even 2%. The goal is to grow steadily until you hit that 50% mark. Once you do, you’ll never fear a hospital bill, a job loss, or an emergency again.

📌 Seal this leak: Start now, no matter how little. Treat savings like rent or electricity - non-negotiable. The habit is more important than the amount.

2. Societal Pressure - Competing With Broke People To Prove You’re Not Broke

If there is a silent killer of finances, this is it.

We live in a world where Instagram reels, TikTok videos, and WhatsApp statuses showcase endless highlight reels. Designer handbags, international schools, Friday brunches, vacations in Dubai that look like trips to Rongai. And what do we do? We compete. We stretch ourselves thin trying to look like we’re winning.

Here’s the painful truth: many of the people you’re trying to impress are also broke. Some are drowning in loans, others rely on sponsors, some are stuck in jobs they secretly hate. But they’ll never admit it. They’ll post their glossy highlights while hiding their financial struggles.

I’ve seen it firsthand. Parents forcing kids into expensive schools they can’t sustain. Couples living in apartments they can barely afford. Young professionals driving cars that bleed them dry in fuel and repairs. All in the name of status.

Your worth is not in your car, your handbag, or your child’s school. Real worth comes from living below your means and building a quiet, solid financial foundation. That’s how wealth is truly built - not by chasing appearances, but by mastering discipline.

📌 Seal this leak: Live within your means, or even better, below your means. If you earn 40,000, discipline yourself to live like a 20,000 earner and save the rest. If you earn 100,000, live like a 50,000 earner. That 50% living principle will feel uncomfortable at first, but it’s the guarantee of financial freedom. The landlord, the bank, and your wallet don’t care about Instagram. Neither should you.

3. Emotional Spending - Using Money To Heal Wounds It Can’t Heal

Let’s go deeper.

Why do we impulse spend? Why do we “treat ourselves” with money we don’t have? Why do we blow 10,000 in a single night and wake up broke on Monday

Most of the time, it has little to do with money and everything to do with emotions. We’re stressed, bored, lonely, or heartbroken. Instead of facing the pain, we swipe our cards.

For some, it’s about proving we’ve “made it” after growing up poor. For others, it’s the infamous black tax - sacrificing our own stability to please family or friends. For many, it’s a scarcity mindset passed down from parents or communities: the belief that wealth is “for other people,” so why even bother?

But here’s the truth: money cannot heal emotional wounds. A new wig won’t mend heartbreak. A car won’t cure insecurity. An expensive school won’t erase childhood trauma. Sometimes what you need isn’t a shopping spree but therapy, prayer, a support group, or simply learning to say no.

📌 Seal this leak: Work on your mindset and emotions. Financial success is only 20% head knowledge. The other 80% is behavior, discipline, and emotional resilience. Until you heal inside, your wallet will always bleed outside.

The Bottom Line: Close The Leaks, Build The Future

Wealth creation is not about how much you earn. It’s about how much you keep.

- Stop lying to yourself that you’ll save when you earn more. Start now, with whatever you have.

- Stop living for Instagram and other people’s approval. Focus on your own race.

- Stop using money as therapy for emotional wounds. Heal first, and your finances will thank you.

But above all, embrace the 50% living rule . Learn to live on half of what you earn, save and invest the rest. It’s not just advice, it’s a lifestyle shift. The moment you hit that threshold, you’re on a guaranteed path to financial independence and even early retirement.

If you close even one of these leaks this year, you’ll notice a difference. Close all three and start applying the 50% principle, and you’ll be shocked at how quickly your financial story changes.

So don’t let money leaks drain your dreams. Seal them, live below your means, and let your money finally start working for you.

👉 Ready to Take the Next Step?

If you’re wondering how to put all this into practice, don’t walk alone. Join our membership community where we share financial, spiritual, and personal growth tools to help you thrive.

Download our Financial Toolkit, get your Kingdom Financial Planner notebook/diary, or grab our eBook - practical resources designed to guide you in saving, investing, and building wealth with clarity.

And if you’d like personalized help in shaping your portfolio or planning your financial journey, reach out to us. We’d love to walk with you, not just in money matters, but in life’s bigger picture too.

💡 Take the Next Step With Set Free Capital

Ready to get serious about your finances?

Visit our website to grab the tools that will help you track, plan, and grow:

- Excel Money Tools Pack – KES 800 only

- Includes templates for budgeting, tracking expenses, calculating net worth, and more.

- Kingdom Finance – First Edition eBook – KES 300

- A biblical guide to saving, investing, and understanding financial principles with practical insight into available investment opportunities.

- Kingdom Financial Planner – KES 1,500

- A full package with planning pages, money trackers, budgeting tools, goal setting sheets, and biblical finance wisdom. This planner is part education, part action.

You can also:

- 📞 Book a one-on-one session with a certified financial advisor.

- 👩❤️👨 Book as a couple and align your finances as a team.

- 🗣️ Invite us for a speaking engagement for your group, church, or team.

- 🧭 Join Set Free Capital CBO — a purpose-driven financial movement. Membership is only KES 1,500.

For a one-time membership fee of only Ksh 1,500 , you get lifetime access to a treasure chest of resources - some completely FREE - including our powerful Kingdom Finance eBook that breaks down everything you need to know about building wealth God's way.

But that’s not all...

You also become part of our vibrant online community - a safe, encouraging space where we:

- Share real-time investment tips

- Alert you to new and rising opportunities

- Celebrate wins together

- Grow our financial knowledge side-by-side

- And yes... hold each other accountable like a true success squad

This isn’t just a membership it’s about fulfilling the call of God to finance His work.

"Living below your means is not about sacrifice; it is about freedom. The less you need, the more you own your time"

Faith Muoti, Financial Peer Educator

📌 Want more tools?

We’ve got free and premium resources on our website — from planners to retirement guides to calculators. Join our lifetime membership for just Ksh 1,500 , and get access to:

- The Kingdom Finance eBook

- Budgeting templates

- Investment Opportunity Alerts

- And many more ...